Author Archives: Mark Combs

- How are plan operations improving by leveraging health claim analytics?

- What improvements are being made to broker & client reporting?

- Can the stop loss claims claim filing & payment process be streamlined? Automated?

- Can the reinsurance quoting process be improved?

- What role can Employee Apps play in member engagement and claims reduction?

- How are health analytics being used to improve healthcare?

Join our diverse panel for a conversation on these topics, and more. Our speakers will be:

Mark Combs – President of SelfInsuredReporting.com, a leading health claim analytics and reporting platform. He is also CEO of PlanWellHealth.com, an employee app that leverages claims data to deliver better health interventions.

John Collier – President of ProactiveMD, a leading Direct Primary Care company offering health management solutions to employers across the country.

Scott Ogburn – Senior Vice President and Consultant at ECM Solutions. Scott is veteran benefit consultant with significant expertise deploying cost containment strategies including population health, direct contracting and direct primary care.

What Do You Know about Self Insured Group Health Plans?

What is a Self-Insured Group Health Plan?

Often referred to as a ‘self-funded’ plan, a Self-Insured Group Health Plan is one where an employer assumes the financial risk associated with providing health insurance to its employees. An employer that elects to “self-fund’ is opting to pay for every out of pocket claim that is incurred by employees. This contrasts with a fully insured plan in which the employer would pay a fixed premium to an insurance carrier.

Why Would and Employer Choose to Go Self-funded?

While every employer has their own reasons for choosing a self-funded insurance option, here are some of the most common:

- Employers do not have to pay for coverage up front to an insurance company. This can help create cash flow for their businesses.

- Employers are free to engage with Drs and provider networks that are best suited to the healthcare needs of their specific employee population.

- The employer can “tailor” their benefits offering to fit the specific needs of their employees. While using claims analytics systems and reviewing plan details employers can customize their plans as needed.

- Reserves not being used for current healthcare costs can garner interest for the employer which creates yet another line of cash flow.

- Employers who Self-fund are not governed by state law, but rather are regulated under federal law.

How Can a Self-Funded Employer Protect Themselves Against Large Medical Claims?

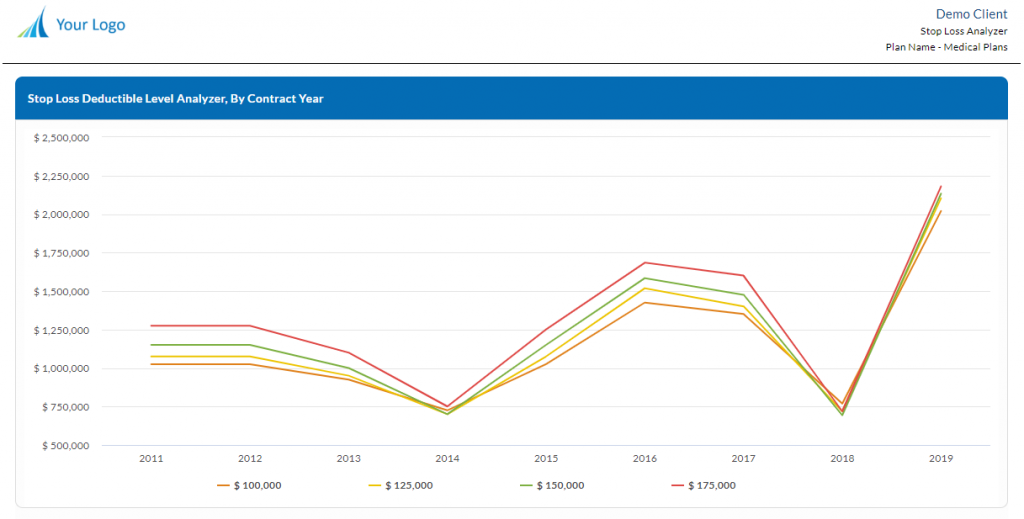

In order to protect themselves against large unforeseen and unpredictable claims, Self-Funded employers purchase what is known as Re-insurance. This is also referred to as Stop-Loss insurance and is designed to reimburse employers for large claims that go above a pre-determined dollar level. This is not a health insurance policy but rather a legal contract between the stop loss carrier and the employer.

How Are Claims Administered on A Self-Insured Group Health Plan?

While some Self-funded employers handle all the administration of employee claims themselves, most choose to outsource this elsewhere. A Third-Party Administrator or TPA for short, is used to process claims, provide data on claims and trends, coordinate the stop-loss coverages, work on provider network contracts and more.

What Law Are Used to Regulate Self-Insured Plans?

As mentioned previously, Self-funded insurance plans to not fall under local or state law. They are instead regulated by federal law under the Employee Retirement Income Security Act (ERISA). Other agencies such as the ADA, COBRA, HIPAA and DEFRA are also used to oversee and regulate these plans federally.

I’m Not Sure Its For You But Self-Funded Health Care Can Save You Money

Many businesses across the country are finding themselves with the same problem, rapidly rising health plan costs. Every year employers loath having to price new health plans for their employees. The employer gets a ton of quotes from carriers, they end up going with the least expensive which usually isn’t very good for the employee, and then next year that rate jumps up even more.

Because of this never-ending cycle of rising health insurance costs, more and more employers are moving to Self-insured healthcare plans (Otherwise known as Self-funded). Under this type of plan style, employers themselves are the ones who pay for the health benefits being provided to the employees. The employer assumes the risk of paying the claims rather than using the more traditional model of letting the insurance company take on that risk.

This type of Healthcare plan option became popular back in 1974, after a new law exempted Self-Funded plans from State regulation. Ever since then the model has moved down market to smaller and smaller companies.

Due to Healthcare Reform among other things, companies are wanting to take more control over their Healthcare spend. By setting up these types of plans, employers are now able to control more readily the costs associated with offering group health insurance.

Is it all sunshine and rainbows?

Wherever there is a payoff, there is an inherent risk. Even though companies who switch to Self-funding do not have to deal with paying premiums to insurance carriers, they do have to pay all the employee medical claims.

Typically, a Self-funded plan is administered by a Third-Party Administrator or TPA for short.

Due to the enactment of the Affordable Care Act in 2010, health insurance pools of covered individuals now include sicker and therefor more expensive individuals. This is mainly due to the provision of the ACA law the prohibits insurance companies from denying coverage to an individual based on pre-existing conditions. In addition, not enough young and healthy people have enrolled to offset the cost of the more high-risk claimants.

The result is that the costs of fully insured group coverage has been soaring. This has led the movement of smaller employers with healthy workforces to consider Self-Funded group insurance options.

More Control Through More Data

An additional perk to self-funded insurance is that the employer has more freedom in plan design and structure. Self-Funded employers can partner with private reporting and analytics companies to look deeply into their own healthcare data. Reports on claims, health trends, claimants, conditions, and the financial health of the plan are all available with the press of a button.

From this data Self-funded employers can know specifically where their largest and most costly claims are coming from. In addition, data on provider utilization is available and therefor employers can better communicate to their employees the various ways they may be able to save money on their medical care.

This new trend in Healthcare cost transparency is leading the migration into Self-Funded plans and saving money for employers all over.

Everything Worth Anything Requires You To Take Action

Knowing Where The Money Goes Is Step 1 To Understanding Healthcare Costs

To Struggle For Something You Want Is To Be Alive! Its Necessary!

There Are No Aspects Of Our Lives In Which Data Is Not Shaping Us

As Much As We Hate To Hear This, We ALL Know It Is True.

Why Exactly Do We Play It Too Safe Most Often? We Have No Excuses!

- 1

- 2